Typical Loan Feature

JOIN US FACEBOOK

The amount a lender is willing to lend to financing your purchase factored in your ratio of debt to income, among other things.

JOIN US TO LINKEDIN

The amount a lender is willing to lend to financing your purchase factored in your ratio of debt to income, among other things.

There’s no right loan for everyone. But there’s a right one for you.

When you’re looking for a new home you probably have a good idea of what you’re looking for – what it looks like, what size it is, even where it’s located, maybe even right down to the street. But when it comes to a loan, where do you start? There are hundreds of loans from a huge choice of lenders. And there are new products coming into the market all the time.

You have to know where to look. And that’s what a broker is here for. We’ll speak to you first to get to know you and get a better understanding of your needs. And then we look at options that suit those needs, to choose one that’s right for you. And then, to make it even easier, we’ll help you take care of the process. We’ll help take care of the paperwork and manage the application process right through to approval.

When you’re ready, why not talk to a broker about your next steps.

Interest only Repayments l Extra Repayment advisor in in Bentleigh.

With Interest-Only and Extra Repayment Consultancy in Bentleigh – Get the Most Out of Your Home Loan.

Interest-only and extra repayment options can be a great way to make the most of your home loan and manage your finances effectively. However, with so many options available, it can be challenging to know which strategy is right for you. That’s where our interest-only and extra repayment consultancy services in Bentleigh come in. Our expert advisors specialize in these areas and can provide tailored advice and guidance to help you get the most out of your home loan. We’ll work closely with you to understand your financial goals and budget, and provide expert recommendations on the best interest-only and extra repayment options to suit your unique needs. With our help, you can confidently navigate the complex world of home loans and achieve your financial goals. Contact us today to learn more about our interest-only and extra repayment consultancy services in Bentleigh.

Our company has extra repayment advisors available to assist you in Oakleigh, Chadstone, Clayton, Moorabbin and Mount Waverley.

Here’s a guide to common loan features and benefits.

Interest Only Repayments:

You have to know where to look. And that’s what a broker is here for. We’ll speak to you first to get to know you and get a better understanding of your needs. And then we look at options that suit those needs, to choose one that’s right for you. And then, to make it even easier, we’ll help you take care of the process. We’ll help take care of the paperwork and manage the application process right through to approval.

Extra Repayments

You have to know where to look. And that’s what a broker is here for. We’ll speak to you first to get to know you and get a better understanding of your needs. And then we look at options that suit those needs, to choose one that’s right for you. And then, to make it even easier, we’ll help you take care of the process. We’ll help take care of the paperwork and manage the application process right through to approval.

Weekly or Fornightly Repayments

Instead of a regular monthly repayment, you pay off your home loan weekly or fortnightly. This can suit people who are paid on a weekly or fortnightly basis, and will save you money because you end up making more payments in a year, cutting the life of the loan.

Redraw facility

This typically allows you to access any extra repayments you have made. Knowing you have access to funds can provide peace of mind. Be aware lenders may charge a redraw fee and have a minimum redraw amount. There might also be other restrictions on when funds can be redrawn.

Repayment holiday

You may be able to take a complete break from repayments, or make reduced repayments, for an agreed period of time. This can be useful for travel, maternity leave or a career change.

Offset account

This is a savings account linked to your home loan. Money paid into the savings account is deducted from the balance of your home loan before interest is calculated. The more money you save, the lower your regular home loan repayments. You can often access your savings in the usual way, by EFTPOS and ATMs. This is a great way to reduce your loan interest, as well as eliminate the tax bill on your savings. Be aware the account may have higher monthly fees or require a minimum balance or have other restrictions.

Direct debit

Your lender automatically draws repayments from a chosen bank account. Apart from ensuring there is enough cash in the account, you don’t have to remember to make repayments.

All in one home loan

This combines a home loan with a cheque, savings and credit card account. You can have your salary paid into it directly. By keeping cash in the account for as long as possible each month you can reduce the interest charges. Used with discipline, the all-in-one feature offers both flexibility and interest savings. Interest rates charged for these loans can be higher.

Professional package

Home loans over a certain value are offered at a discounted rate, combined with discounted fees on other banking services. These can be attractively priced, but if you don’t use the banking services you may be better off with a basic variable loan.

Portable loans

If you sell your current property and buy somewhere else you can take your home loan with you. This can save time and set-up fees, but you may incur other charges.

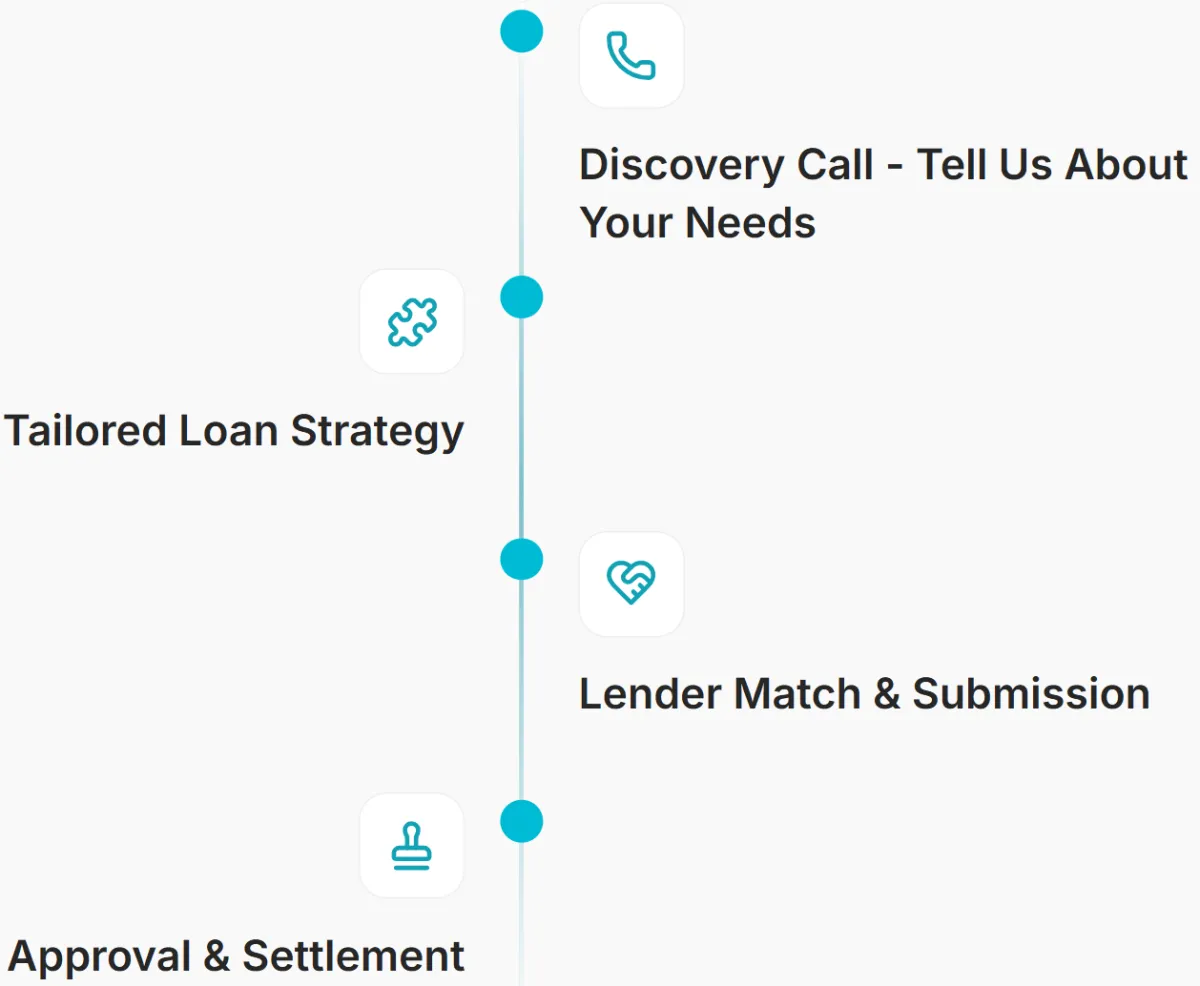

Our Simple 4-Step Loan Process

Main Links

Main Services

ASK Financials © 2026. All rights reserved.

This is a Paragraph Font

ASK Financials Mortgage Brokers ABN: 48661070962. Credit Representative # 543187 is authorised under Australian Credit License #389087.

Disclaimer: This page provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. It does not constitute legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.